A cash receipts journal is a special journal used to record cash received by a business from any source. The major sources of cash receipt in a business include:

The cash receipts journal is used to record all transactions involving the receipt of cash, including transactions such as cash sales, the receipt of a bank loan, the receipt of a payment on account, and the sale of other assets such as marketable securities.

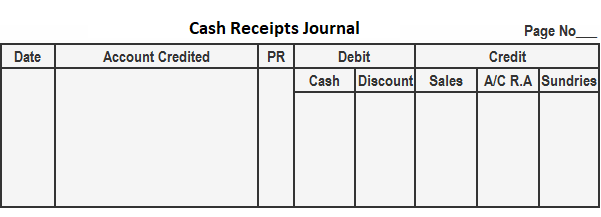

The image below shows a standard cash receipts journal. As the example shows, a typical cash receipts journal consists of many columns. This is necessary because there are numerous transactions that lead to the receipt of cash.

The debit columns in a cash receipts journal will always include a cash column and, most likely, a sales discount column. Other debit columns may be used if the firm routinely engages in a particular transaction.

In the example below, the only other debit column is the other accounts column. This column is divided into three parts:

If desired, the area for the name of the account in this column can be replaced with an area for account numbers.

The credit columns in a cash receipts journal will most often include both accounts receivable and sales. Again, other columns can be used depending on the type of routine transactions that the firm engages in.

In our example, the only other credit column featured in the cash receipts journal is for all other accounts. It is set up in the same way that the other column on the debit side is, except that the account title area is replaced by a "Ref." column.

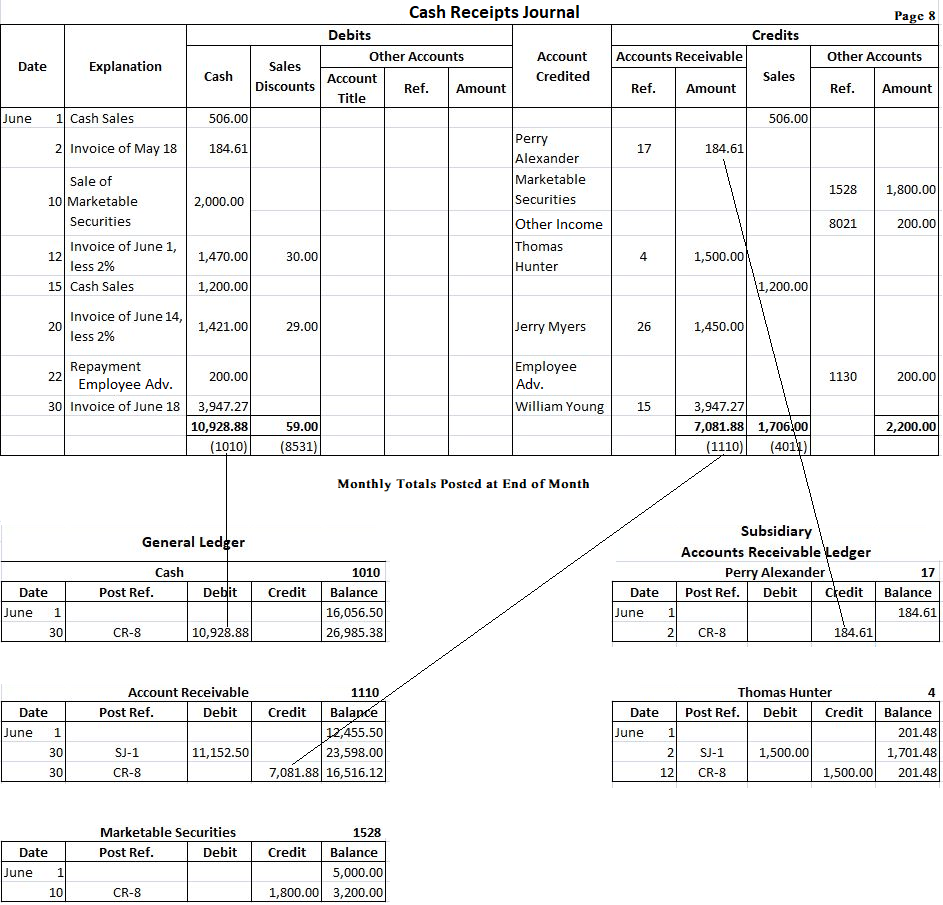

To learn more about how cash receipts journals are used, let's consider an example.

Assume that, during June, the Fortune Retail Store made the following transactions involving cash receipts:

June 1: Cash sales totaled $506

June 2: Collected from Perry Alexander (account no. 17) $184.61 from the sale made in May. No sales discount allowed

June 10: The firm sold marketable securities for $2,000 that were purchased for $1,800

June 12: Collected $1,470 on account from Thomas Hunter (account no. 4), Sales discount of $30 allowed

June 15: Cash sales totaled $1,200

June 20: Collected $1,421 on account from Jerry Myers (account no. 26). A sales discount of $29 allowed

June 22: Repayment of employee advance of $200

June 30: Collection on account from William Young (account no. 15). Total received is $3,947.27, which represents an outstanding balance of $147.37 on June 1 and subsequent sale on June 18. No discount allowed.

To log these transactions in a cash receipts journal, each of these transactions is entered sequentially into the journal in the appropriate column.

For example, the cash sale on June 1 is recorded in the cash receipts journal by first entering June 1 in the date column.

Cash sales are entered in the explanation column. The amount of $506 is then placed in both the cash debit column and the sales credit column.

In this example, it is not necessary to make an entry in the account credited column. This is because the entry in the cash and the sales columns makes it clear that this is a cash sale. Other entries are made in a similar fashion.

Depending on a company's requirements, different formats are used for a cash receipts journal. To help you understand the recording procedure, a simple format is given below.

An overview of the purpose of each column in the specimen shown above is given as follows:

1. Date column: Used to record the date at which cash is received by the business.

2. Accounts credited column: Used to enter the title of the respective account on which cash is being received.

3. Posting reference column: Used to write the number of the ledger account at the time of posting.

4. Cash column: Used to record the total amount of cash received.

5. Discount column: Used to record the amount of cash discount allowed at the time of receiving cash.

6. Sales column: Used to record the sale of merchandise for cash.

7. Accounts receivable column: Used to to record cash received from customers.

8. Sundry accounts column: Used to record the credits to any account for which there is no special column (e.g., receipt of interest, receipt of cash for the return of merchandise purchased on cash, and so on).

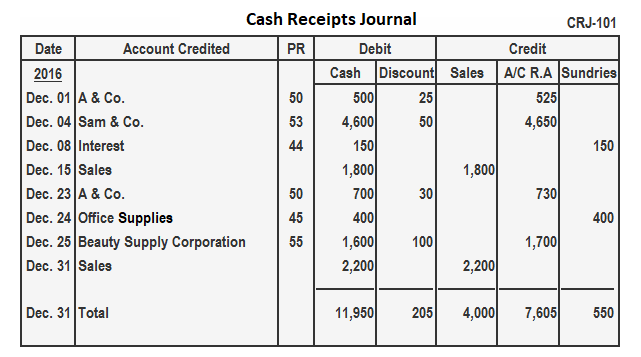

For the year 2016, record the following transactions in a cash receipt journal:

Dec. 01: Received $500 from A & Co. in full settlement of his account of $525

Dec. 04: Received $4,600 from Sam & Co. and allowed discount of $50

Dec. 08: Received $150 as interest on investment

Dec. 15: Cash sales for the first half of the month $1,800

Dec. 23: Received payment of $700 from A & Co. for goods sold on account, and discount allowed of $30

Dec. 24: Sold office supplies for cash $70

Dec. 25: Received $1,600 cash from Beauty Supply Corporation and allowed a cash discount of $100

Dec. 31: Cash sales for the second half of the month $2,200

The procedure for posting the cash receipts journal is described below:

As with other journals, the cash receipts journal is posted in two stages. Any entries in the accounts receivable column should be posted to the subsidiary accounts receivable ledger on a daily basis.

This ensures that the individual customers' accounts are up to date and accurately reflect the balance owed at that date.

As these accounts are posted, the account number is entered into the post reference column. In the subsidiary ledger, the post reference is "CR-8", which indicates that the entries came from page 8 of the cash receipts journal.

At the end of the month, the different columns in the cash receipts journal are totaled. The totals from all the amount columns (other than the other account column) are posted to the appropriate general ledger accounts.

Again, in the general ledger accounts, the post reference "CR-8" is recorded to indicate that these entries came from page 8 of the cash receipts journal.

The amounts in the other accounts column must be posted accurately. Although these amounts are often posted at the end of the month, they could be posted more frequently. As they are posted, the account numbers are placed in the post reference column.

A check is placed under the total of this column as this total is net posted.

The postings are shown in the above example for the general ledger accounts: Cash, Accounts Receivable, Marketable Securities, and two selected subsidiary ledger accounts receivable accounts (namely, Perry Alexander and Thomas Hunter).

A cash receipts journal is a special journal used to record cash received by a business from any source.

It includes investment of capital by the proprietor or owner, cash sales, sale of an asset for cash, collection from customers, collection of interest, dividends, or rent and loan from an individual, bank, or any other financial institution.

The cash receipts journal is used to record all transactions that result in the receipt of cash. This includes receipts from customers, debtors, and other sources.

The total from each column in a cash receipts journal is posted to the appropriate general ledger account. In addition, the post reference “cr” is recorded to indicate that these entries came from the cash receipts journal.

A common error made when posting entries from a cash receipts journal is to forget to post the individual amounts in the accounts receivable column to the subsidiary ledger accounts receivable. This can cause the customer’s account to be inaccurate and may result in the customer being overcharged or undercharged.

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.